Overview

Ghana has faced various economic challenges over the years. These challenges have led the country to seek external assistance, including financial support from international organizations such as the World Bank and the International Monetary Fund (IMF). These challenges led to the introduction of the DDEP, which subsequently led to the depreciation of the cedi against the dollar and other major currencies, as well as high inflation levels in the country. The introduction of the DDEP led to investors losing confidence in the Bond market and has since remained unattractive over the years. The nation’s financial markets have witnessed mixed responses, as investors cautiously navigate an environment of uncertainty.

The Bank of Ghana, in an effort to deal with these challenges, introduced the Ghana Gold Coin (GGC) for two main reasons: (i) to mop up excess liquidity to help reduce the stress on the dollar, which causes the cedi to depreciate and subsequently lead to high inflation levels; and (ii) to add another investment instrument to the existing ones we have on the market.

Gold has demonstrated remarkable resilience as a financial asset globally over the years and can serve as a natural hedge during periods of economic turbulence. The issuance of the GGC gives access to this enduring financial asset, enabling residents to diversify their financial portfolios.

The GGC issuance aimed to enable the BoG to mop up excess cedi liquidity in the banking sector, supplementing the use of Bank of Ghana bills and overnight deposits for its open market operations.

In the context of this study, the GGC represents a new financial security option for investors to explore in the country; hence, there is a potential impact of the coin on the financial markets of Ghana.

To assess this impact, the study examines the performance of the Coin since the Bank of Ghana launched it on September 27, 2024, and commenced trading in November 2024 2024. It examines the concept of market reactions and subsequent price volatility, based on the previous day’s London Bullion Market Association (LBMA) afternoon (PM) price, illustrating the trend analysis approach.

Trend analysis is commonly used in finance to examine and evaluate data, identifying patterns to make informed predictions about future changes in specific events related to asset prices and market behavior.

This study focuses on analyzing the trend of GGC prices over specific periods to identify potential investment strategies and how investors can integrate this with existing securities issued by the Bank of Ghana. It also aims to examine the performance of the GGC against the USD as a more effective way of hedging to alleviate stress on the dollar and thereby strengthen the Ghanaian cedi.

Methodology

In this note, we employ trend analysis to examine the performance of the GGC following its inception on the London Bullion Market on November 25, 2024, and compare it to the performance of the dollar with respect to the USD/GHS rate, as well as the performance of global gold prices.

To fully measure the performance of the coin, we harmonize data from different sources and in various units of measure to increase the level of compatibility. We also adopt some models to measure returns. Specifically, we compute normal returns using the Holding Period Return model (since the time horizon of our data is less than a year) to measure the sensitivity of additions and withdrawals of funds, as it neutralizes the effect of cash withdrawals and additions to the portfolio.

Data and Summary Statistics

We collect daily data on the two main markets. For the Gold Prices, we use the previous day’s London Bullion Marketing Association (LBMA) Auction afternoon (PM) Price. For the Forex market, we use the data from the Bloomberg REGN Mid-Rate USDGHS exchange rate. We chose May 30, 2025, as the closing date, given that the GGC started trading on the London Bullion Market in November 2024, which marks the exact 6-month period under review of our study.

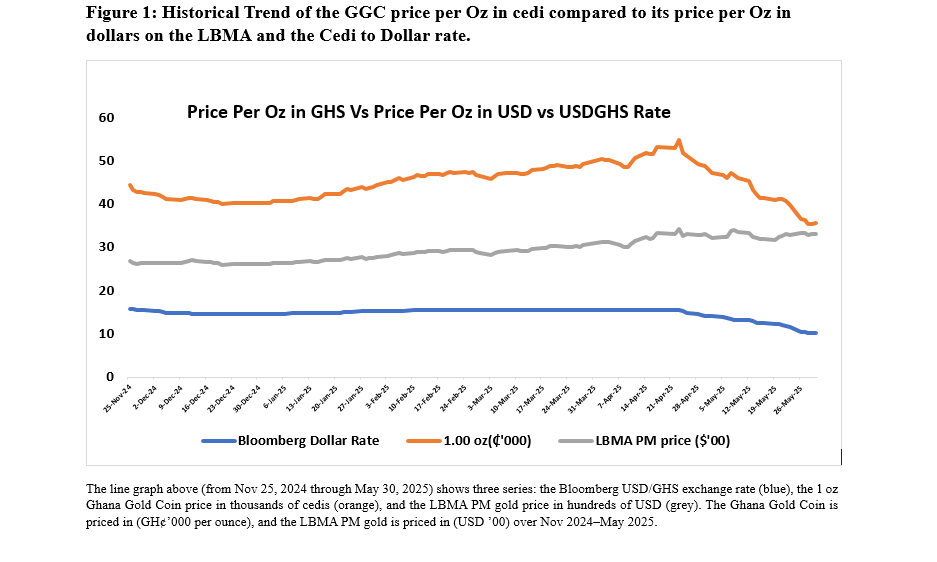

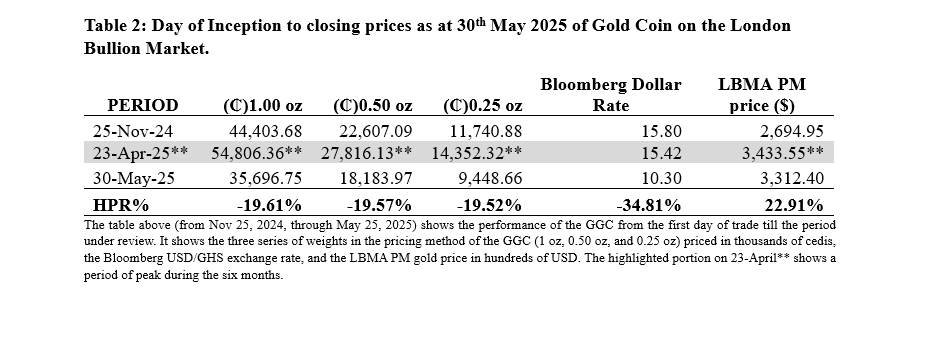

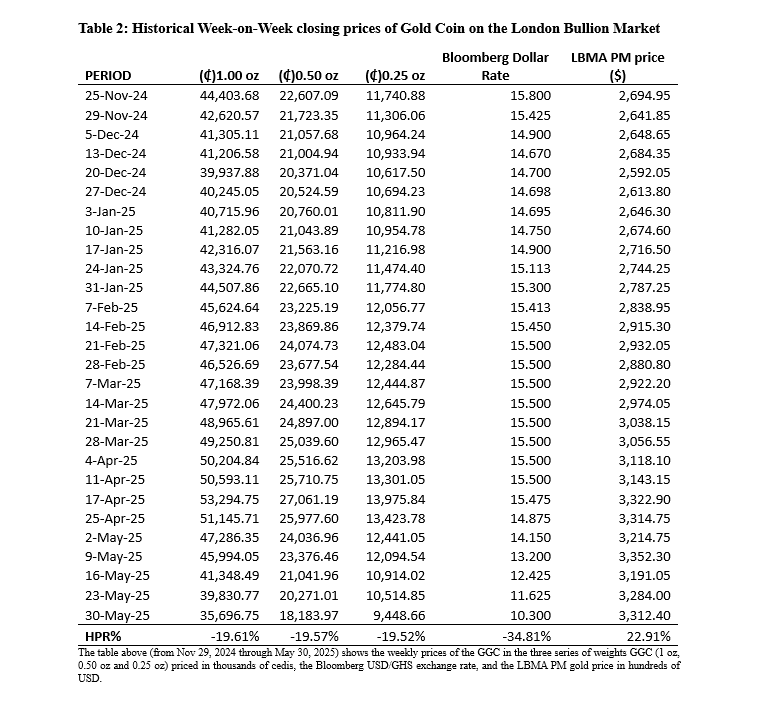

Figure 1 illustrates the trend of the historical daily closing price series of the GGC, based on the LBMA PM prices in cedis, against its price in dollar terms, as per the Bloomberg REGN Mid-Rate USDGHS exchange rate. From Figure 1, we observe that the Bloomberg USD/GHS rate decreased (cedi strengthened) over the period, from approximately 15.8 in late November 2024 to 10.30 by May 30, 2025. The LBMA PM gold price increased from $2,694.95 to $3,312.40 (in U.S. dollars per ounce). The Ghana 1-oz coin price experienced some significant volatility over the period. It dropped from GH¢46,155 on November 25 to GH¢42,390 by December 2, climbed to a peak of around GH¢54,806.36 by April 23, and eased to GH¢35,696.75 by May 30.

Generally, a higher LBMA gold price tends to push up the local gold-coin price, while a stronger cedi (lower USD/GHS) tends to pull it down. During this period, there was no simple one-to-one correlation between USD/GHS and LBMA. For example, by early May, the LBMA gold price was near its high, while USD/GHS was at its low (a strong cedi). In other words, gold prices and the Ghana cedi moved somewhat inversely; that is, when LBMA rose, it put upward pressure on the gold-coin price in cedis, but when USD/GHS fell, it offset some of that increase.

The coin price experienced significant volatility. The sharp decline in late November and early December 2024 (the gold coin fell by about 8% in a week) was a period of divergence (LBMA price was almost flat while the cedi strengthened). From January to April 2025, the coin price trended upward, along with global gold on the LBMA. The late April 2025 peak coincided with LBMA rising above $3,100 to $3,433.55 on April 23. Finally, in early May, the coin price began dropping significantly as the cedi strengthened rapidly (the USD/GHS rate fell), even though LBMA prices remained near their high.

Overall, the volatility in gold-coin price movements reflects a combination of the rising global gold price and shifts in the cedi’s value. That is, when the international gold price rises in tandem with a strong dollar, the Ghana coin price increases, while a strengthening cedi pulls the local price down. However, when the global gold price rises at a rate faster and broader than the rate of cedi appreciation, it offsets the difference, which is reflected in the rising prices of the Ghana gold coin.

Over the period from November 2024 to May 2025, the Ghanaian cedi strengthened against the dollar (USD/GHS decreased), global gold prices rose, and the Ghana Gold Coin price exhibited a mixed pattern, tracking these forces. The chart highlights these opposite moves: the LBMA gold steadily climbs, the USD/GHS gradually falls, and the Ghana gold coin rises and falls in response to the USD/GHS decline at a pace faster than the rise in global gold prices. While the strengthening of the cedi against the dollar is one of the main reasons the GGC was introduced, it tends to devalue the gold coin when the difference in rising global gold prices does not offset the vacuum created by the cedi’s appreciation against the dollar.

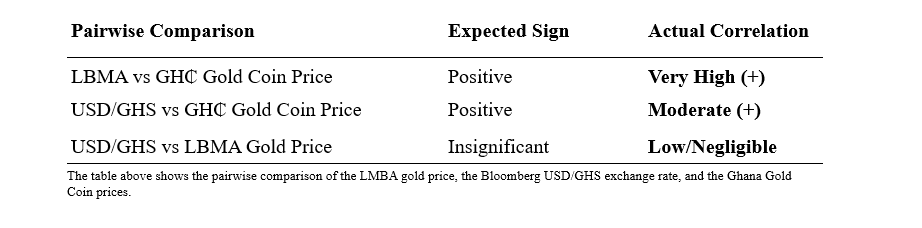

The table illustrates the relationship between international and local gold prices, as well as the influence of exchange rates. It shows a very strong positive correlation between the LBMA gold price and the Ghanaian cedi (GH₵) gold coin price, confirming that local gold pricing closely follows global market trends. A positive correlation exists between the USD/GHS exchange rate and the gold coin price, indicating that exchange rate fluctuations do impact local gold prices. Meanwhile, the correlation between the USD/GHS exchange rate and the LBMA gold price is negligible, reflecting the independence of global gold prices from Ghana’s currency movements. This suggests that Ghanaian investors in gold are primarily influenced by international gold price movements, with exchange rate volatility having a secondary effect.

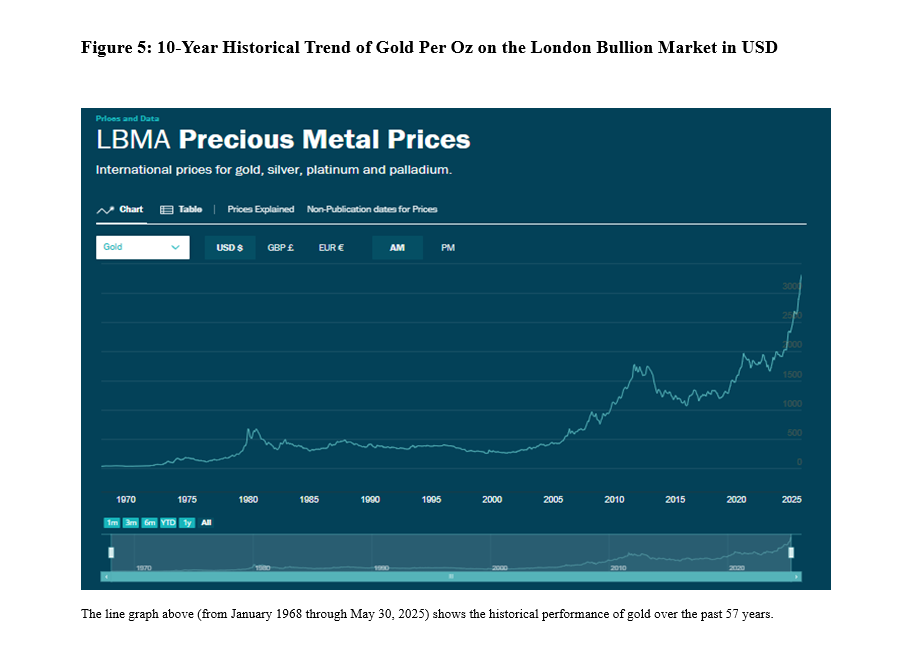

Concerning how long the GGC has traded over the period since it was introduced, it is very important to note that the GGC pricing method follows an already exiting market trend in the graph below, which is the London Bullion Marketing Association (LBMA) Auction afternoon (PM) Price, which has been trading for the past 57-years, that is from January 1968 till date. The basis for the pricing of GGC is the previous day’s London Bullion Market Association (LBMA) afternoon (PM) Price, which in the case of GGC is priced in United States Dollars against the Ghana Cedi rate, quoted using the previous day’s close Bloomberg REGN Mid-Rate.

This implies that the GGC’s future performance, all other things being equal, can be predicted from the past performance of the LBMA over the years.

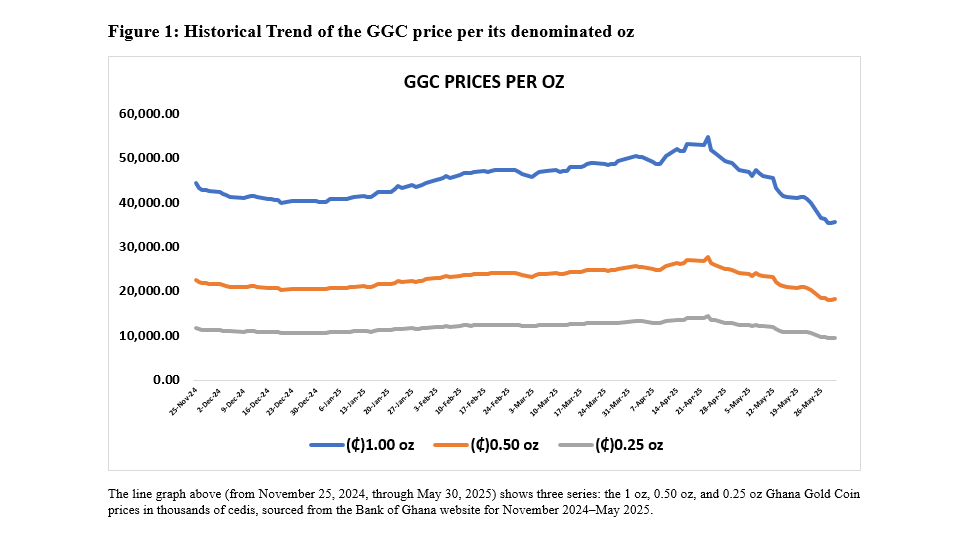

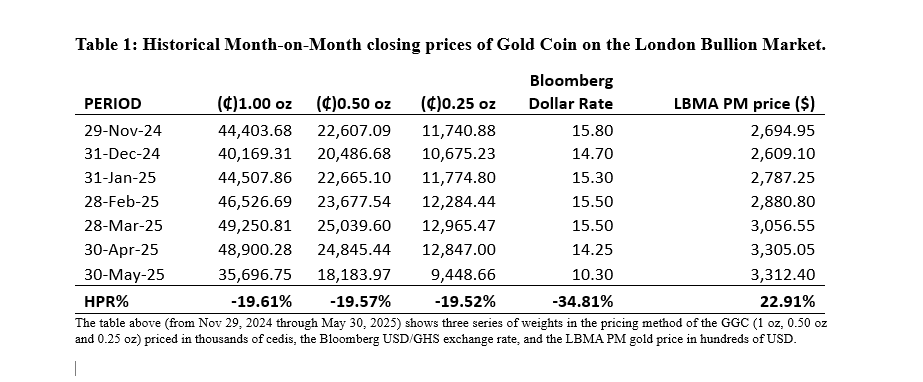

Between November 2024 and May 2025, the prices of gold coins in Ghanaian cedis showed a clear upward and downward trend across all denominations. The 1.00 oz gold coin, for instance, increased from ₵42,620.57 in November 2024 to ₵49,250.81in March 2025, representing a total percentage gain of 15.56%. While there was a brief decline in December 2024, gold coin prices rebounded strongly from January through to a peak in April 2025 and declined significantly by the end of May 2025 to ₵35,696.75. This loss occurred, despite the gains in gold prices on the international market, due to the appreciation of the cedi against the dollar as indicated by the Bloomberg cedi-to-dollar rate, which experienced about 35% appreciation against the dollar as at May 30, 2025.

Although the LBMA PM gold price increased sharply from $2,641.85 in November to $3,312.40 in May, marking a substantial 22.91% rise, the pace of the USD/CHS exchange rate dragged down the price of the coin in local terms significantly. This surge in the global gold price was the primary driver behind the increase in cedi-denominated gold coin prices from January to April. However, by the end of May, the strengthening of the cedi exerted downward pressure on local prices. The consistent and significant rise in global gold prices was offset by the appreciation of the cedi against the dollar, resulting in a negative Holding Period Return in the local market value of gold coins.

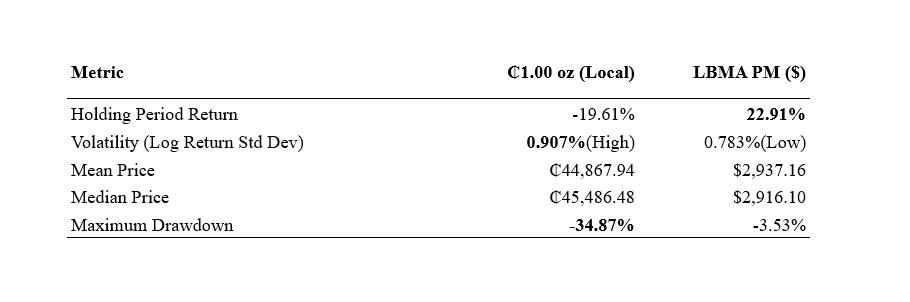

The table provides a comparative analysis of the performance and risk profile of gold priced in Ghanaian cedis (₵1.00 oz) versus the international LBMA PM price in U.S. dollars. Over the analysis period, the local gold investment experienced a negative holding period return of 19.61%, indicating a significant decline in value, whereas the LBMA PM gold price saw a positive return of 22.91%, reflecting growth.

In terms of volatility, the standard deviation of the log returns indicates that the local gold price was significantly more volatile (0.907%) than its international counterpart (0.783%), suggesting higher price fluctuations and greater risk for local investors. Despite this, the mean and median prices of local gold (₵44,867.94 and ₵45,486.48) were relatively consistent, though still subject to significant short-term movements. The LBMA gold prices were more stable, with a mean of $2,937.16 and a median of $2,916.10.

Finally, the maximum drawdown, which measures the worst peak-to-trough decline, was far steeper for the local price (-34.87%) compared to -3.66% for the LBMA price. This indicates that investors in Ghanaian cedi-denominated gold faced considerably higher downside risk during the period. Overall, the data suggest that the LBMA PM gold price provided better returns and lower risk, making it a more stable and attractive investment relative to the local market.

Discovered Hindrances

Gold has long been regarded as a premier financial asset and a reliable hedge against inflation and economic uncertainty. The strategic decision by the Bank of Ghana to issue the Ghana Gold Coin (GGC) represents a commendable move towards diversifying financial instruments and promoting local investment in precious metals. However, a structural pricing challenge persists that could undermine investor confidence in the long term.

Unlike markets where gold investments are denominated in U.S. dollars and exchange rate is not an issue, the GGC is priced in Ghanaian cedis, with its valuation derived from the London Bullion Market Association (LBMA) spot price converted at the prevailing USD/GHS exchange rate. This conversion mechanism renders the value of the gold coin highly sensitive to fluctuations in the foreign exchange market.

Empirical analysis of market behavior over the past six months suggests that during periods when the Ghanaian cedi appreciates against the U.S. dollar, the local value of the GGC often declines, particularly when the LBMA gold price does not experience a significant increase or remains flat, unable to counteract the currency appreciation. For instance, 26th May was a holiday in the UK, and the price of gold remained the same for 26th and 27th. However, the GGC market price declined due to the cedi’s appreciation during that period. This inverse relationship poses a latent risk: investors who purchase the coin during a period of cedi weakness (i.e., a higher USD/GHS exchange rate) stand to incur mark-to-market losses if the cedi subsequently strengthens.

Although cedi appreciation has macroeconomic benefits, such as easing import costs and bolstering overall economic stability, it inadvertently penalizes holders of GGCs, thereby disincentivizing domestic investment in the asset.

Now, to curb the issue above, it is high time the BoG finds a way of adopting the method and practice used by the LBMA in pricing gold on the global market so that the coin will be priced solely in Ghanaian cedis to avoid the issue of investors losing the value of their investment in the gold coin.

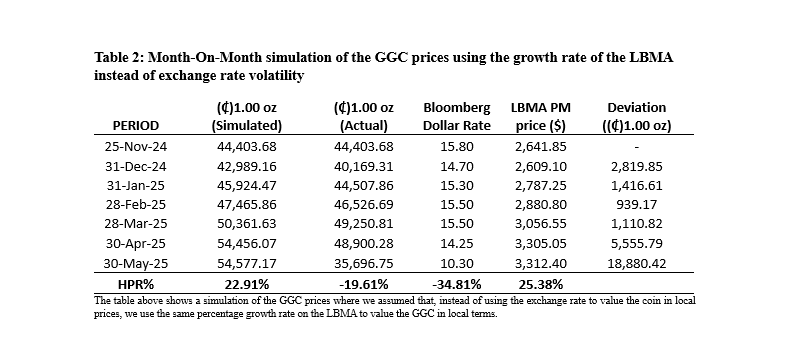

For Instance, the table below is a simulation where it is assumed that the GGC price rises and falls with respect to the same growth rate of gold prices on the LBMA.

From the simulation, it is realized that adopting a valuation model that uses the LBMA PM gold price growth rate, rather than relying on exchange rate fluctuations, offers a more accurate and stable reflection of the true value of the GGC. This approach aligns local pricing with global gold market trends, protecting against the volatility of currency markets that often distort asset values. Comparing both approach (the growth rate and the exchange rate for valuation), while gold appreciated internationally, the actual cedi value of the coin declined when exchange rates were used, discouraging investors and undermining the GGC. However, the growth rate model, not only boost investor confidence by showing consistent returns but also shows the true performance and worth of the GGC. It ultimately ensures that gold coins maintain their intrinsic value regardless of external macroeconomic pressures

Conclusion

This note examines the performance of the Ghana Gold Coin (GGC) over the past months and documents several compelling insights. Launched by the Bank of Ghana as an innovative, gold-backed investment option, the GGC was designed to serve as a hedge against inflation and a tool for promoting economic resilience. While it provides some protection against inflationary pressures and currency volatility, its pricing mechanism, pegged to the LBMA gold spot price and converted using the prevailing USD/GHS exchange rate, renders it highly susceptible to fluctuations in exchange rates.

When the cedi appreciates without a matching increase in the global gold price, the local value of the coin declines, posing a risk of capital loss for holders. Conversely, depreciation of the cedi tends to boost the value of the coin. This interaction created an inverse relationship between cedi strength and coin returns, resulting in a volatile price pattern. Ironically, while a stronger cedi reflects macroeconomic stability, it undermines the performance of the GGC in local terms, creating a deterrent for domestic investors seeking capital gains rather than simply wealth preservation.

Additionally, the timing of the GGC’s introduction, coinciding with economic challenges such as fiscal tightening and the Domestic Debt Exchange Programme (DDEP), may have influenced its initial reception. During this period, investor sentiment was relatively low, and the high price point of the coin made it less accessible to many Ghanaians. As a result, the GGC has so far appealed primarily to a narrower segment of investors, limiting its broader role in advancing financial inclusion..

To address this challenge, introducing a GGC-backed mutual fund or unit trust could enhance accessibility by allowing individuals to invest in smaller, more manageable amounts. This approach would encourage broader participation across different income groups and offer a more inclusive path to gold-backed investment. Additionally, it could help moderate the preference for the U.S. dollar as a safe haven by offering a credible local alternative, thereby contributing, over time, to greater stability of the cedi. Such a structure would also provide investment firms with opportunities to mobilize more capital and promote more active engagement with gold as a domestic investment asset.

In summary, while the Ghana Gold Coin represents a useful addition to the country’s financial offerings, its impact will depend on efforts to manage pricing dynamics, improve accessibility, and align investor incentives with wider economic objectives. Ongoing adjustments by policymakers and investment managers can help the coin function both as a reliable store of value and a vehicle for supporting more inclusive participation in investment opportunities.

About the author:

The author is a Research and Investment Analyst at Nimed Capital Limited, a CFA candidate, and a former Research Assistant at the University of Ghana Business School.