5.6 trillion won to reduce the burden of the cost of living… 1 trillion added to the People’s Livelihood Stabilization Fund

Realizing the era of the working class and middle class through a dynamic economy

- Reporter nameReporter Nam Gi-woong, Mobile Reporting Department

- Entered 2024.07.04 03:19

Real estate PF stabilization, liquidity supply of KRW 94 trillion… When companies expand shareholder returns

, 230,000 more employed with corporate tax deductions, 10th place in the world in the capital market as a value business, 50,000 venture companies after 10 years

[Mobile Reporter Nam Ki-woong] The government will set aside 5 trillion won to manage prices and reduce the burden of living expenses in the second half of the year. It was decided to invest 600 billion won in finances, and an additional 1 trillion won in funds to stabilize people’s livelihoods.

In addition, in order to foster high-tech industries, the application of the national strategic technology investment tax credit, which is set to expire at the end of this year, will be extended by one year, and the government will support the revitalization of domestic demand by expanding the scope of electric vehicle subsidies.

On the 3rd, the government announced the ‘Economic Policy Direction and Dynamic Economy Roadmap for the Second Half of 2024’ with these contents as its main focus.

First, the government raised its economic growth forecast for this year from 2.2% to 2.6%. This takes into account the better-than-expected export recovery.

This year’s current account balance forecast was also revised from $50 billion to a $63 billion surplus. The consumer price increase rate compared to the previous year was maintained at 2.6% predicted at the beginning of this year, and the number of employed people was also expected to increase by 230,000, maintaining the forecast at the beginning of this year.

◆Injection of 5.6 trillion won for price management

The government predicted that the inflation rate would slow down in the second half of this year, but it was expected that the economy would be difficult for the time being due to the impact of high inflation and high interest rates, which had already accumulated for a considerable period of time.

Accordingly, in the second half of the year, it decided to inject 5.6 trillion won of finance to manage prices and reduce the burden of the cost of living.

In the second half of the year, the government will apply quota tariffs (160 billion won) on 51 agricultural products and food ingredients, including fruits and orange concentrates, and will stock up on 14,000 tons of garlic, onions, and dried peppers.

Kim, which has seen a steep rise in prices in recent years, is developing a new fish farm with an area of 2,700 hectares.

For low-income groups, such as housing and education benefit recipients and second-tier and single-parent families, the selling price of government grain (40% of the market price) will be further reduced by 20%, and a discount event for the use of Korean beef and Korean don charity will also be held in September.

From December, it will also diversify transaction methods such as long-term reservation transactions to revitalize the online wholesale market for agricultural and fishery products.

◆Injection of 1 trillion won in the people’s livelihood stabilization fund

The government has decided to provide an additional 1 trillion won to the people’s livelihood stabilization fund through changes to the fund management plan.

The target of 200,000 won subsidy for electricity costs for small businesses will be expanded from annual sales of 30 million won or less to 60 million won, and the target of loan support will be expanded from low credit to medium credit.

It was decided to provide an additional 41,000 people with loan payments for unpaid wages, 3,000 to support loans for employers and workers in arrears of wages, and 6,000 more to support low-income workers’ livelihood stabilization funds.

In addition, the government will increase the budget for next year’s people’s livelihood support by more than 1.5 times the growth rate of total expenditures, increase the number of people receiving national scholarships (1 million → 1.5 million), labor scholarships (140,000 →200,000) , and establish housing scholarships (up to 2.4 million won per year).

The government will review the proposal to raise the parental leave benefit from 80% of the regular wage, relax the income standards and self-payment for childcare services, and gradually expand the provision of meals per senior citizen from five days a week to every day. .

◆Temporary investment tax credit for semiconductors and future vehicles extended for one year

In order to support the competitiveness of high-tech industries such as semiconductors and future cars, the government will push for a one-year extension of the deadline for applying the National Strategic Technology Investment Tax Credit, which is set to expire at the end of this year. In order to revitalize the construction economy, which is expected to be sluggish, the scale of construction investment and financing in the second half of the year will also be increased by 15 trillion won.

Major legislative tasks include ▲ extension of the deadline for applying the temporary investment tax credit by one year ▲ consideration of one homeowner when an existing single homeowner acquires one house in a depopulated area ▲ allowing online delivery within the business hours of large supermarkets ▲ abolition of urban living housing construction regulations (less than 300 households) ▲ establishment of a mini-tourism complex and transfer of the authority to designate and approve ▲ relaxation of the consent requirement for the establishment of a small housing improvement business association.

In order to revitalize domestic demand, it also introduced a plan to support the purchase of expensive cars with three packages.

As of this year, the target of the additional subsidy for electric vehicles in proportion to the industry discount, which is currently only applied to electric passenger vehicles, will be expanded to electric freight vehicles, and measures to reduce 70% of the individual consumption tax on replacement of old vehicles from the limit of 1 million won will be re-enacted. In addition, the special application period for individual consumption tax reduction for eco-friendly vehicles will be further extended until 2026.

Hybrids, electric vehicles, and hydrogen vehicles will be targeted, but the specific reduction limit will be included in the tax law revision bill scheduled to be announced at the end of this month.

It will also revitalize domestic tourism by institutionalizing the private lodging business and rationalizing regulations, and will issue 200,000 domestic tourism accommodation coupons for non-metropolitan areas during Chuseok.

◆Real Estate Recession Investment and Loan Expansion of 15 Trillion Won

The government has decided to increase the scale of public investment, private projects, policy finance investment and loans by more than 15 trillion won in the second half of the year to revitalize the stagnant construction economy.

By expanding investment in public institutions to 2 trillion won in the second half of the year and discovering new facilities for the private sector, the target of discovering new private investment projects this year will be increased from 15.7 trillion won at the beginning of the year to more than 20 trillion won.

The amount of policy finance loans and guarantees will be increased by 8 trillion won from the existing 598.9 trillion won to 606.9 trillion won.

In addition, experts will be dispatched preemptively when there is a concern about construction cost disputes, and the deadline for submitting construction data will be shortened from 5 months to 3 months to expedite the verification of construction costs.

In addition, the Ministry of Land, Infrastructure, and Transport will form a TF of related ministries to analyze the factors of rising construction costs and prepare customized response plans for each item and item in the second half of the year.

Then, while revitalizing the real estate economy, it will provide liquidity worth 94 trillion won to prevent project financing (PF) instability.

We will induce timely liquidity provision and correction of unreasonable matters related to the PF system for normal business sites, and support the normalization of the PF normalization fund (KRW 1.1 trillion) and the purchase of business sites by the Korea Housing and Land Corporation (LH ) (KRW 3 trillion) for business sites that lack business feasibility.

In order to advance the real estate development method, the ‘Real Estate PF System Improvement Plan’ will be prepared through the reorganization of the PF business structure in the second half of this year.

In order to induce the expansion of the equity ratio of the PF business, incentives will be differentiated according to the equity ratio, and equity investment by financial investors will be promoted.

Measures will be taken to strengthen the feasibility evaluation of real estate PF loans and to ensure the soundness of PF market participants. Through the establishment of an integrated real estate PF information system, the company plans to strengthen the transparency of the PF market and systematize management.

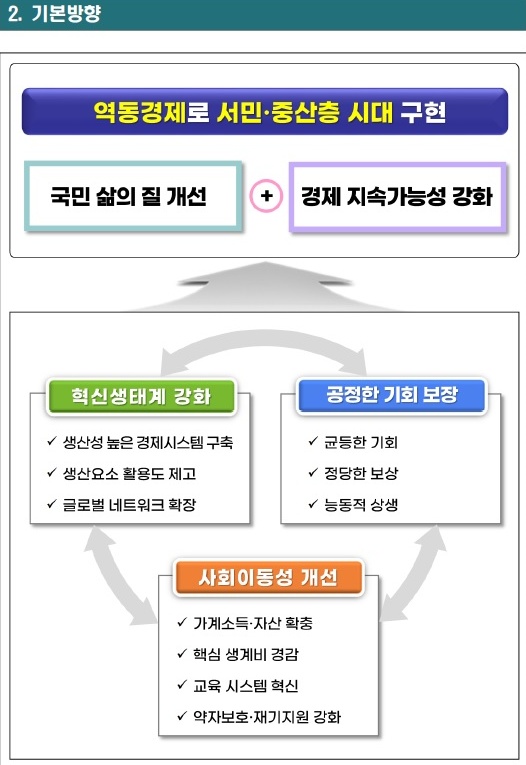

At the same time, the government has prepared a roadmap for a dynamic economy for the realization of the era of the common people and the middle class.

In order to revitalize the capital market, the government will grant tax incentives that deduct 5% of the increase in shareholder returns of value-up companies from corporate tax, and officially abolish the surcharge on the valuation of the largest shareholders’ shares, which has been cited as a factor that increases the burden of corporate succession.

In addition, with the goal of becoming the world’s No. 1 free trade agreement (FTA) signed by 2027, the company plans to establish a trade policy roadmap and announce it in the second half of the year, and increase economic productivity by increasing the number of venture companies by more than 10,000 over the next 10 years.

◆Abolition of inheritance tax maximum shareholder surcharge

The government seeks to “increase the value” of companies and advance the capital market by providing tax support to companies and promoting the improvement of corporate governance.

In particular, the tax law revision bill, which is scheduled to be announced at the end of this month, will include the abolition of the premium assessment for the largest shareholder, which has been demanded mainly by the business community. The current inheritance tax system applies a top tax rate of 50% to inheritances exceeding 3 billion won.

However, if the largest shareholder of a company inherits shares to a related party such as a family member, 20% of the valuation of the stock is added in the name of a premium for management rights, and 60% of the inheritance is taxed. Therefore, the abolition of the largest shareholder surcharge will have the effect of lowering the inheritance tax rate by 10%.

In addition, if a company increases shareholder returns, such as dividends or stock buybacks, it will deduct 5% of the increase from corporate tax.

The eligibility for family business inheritance deduction for value-up companies will be expanded from ‘small and medium-sized enterprises and mid-sized companies with sales of less than 500 billion won’ to all small and medium-sized companies, excluding companies with limited shareholders, and the limit will be increased from a maximum of 60 billion won to 120 billion won.

In addition, the dividend income tax rate on the increase in dividends of companies will be reduced from 14% to 9% and taxed separately.

Under the current tax system, dividends received by investing in domestic stocks are subject to dividend income tax of 14%, and if the combined interest and dividends exceed 20 million won, the tax rate increases to a maximum of 45%.

Under this plan, dividend growth will be subject to separate taxation at the rate of 9%, and the maximum tax rate will be reduced from 45% to 25% even if comprehensive taxation is chosen.

Subsequently, the contribution limit for individual wealth management accounts (ISAs) will be increased from 20 million won to 40 million won per year, and the tax-free limit will be increased from 2 million won to 5 million won. The abolition of the financial investment income tax, which is scheduled to be introduced next year, will also be promoted in the tax law revision bill in the second half of the year.

Through these measures, the government aims to raise the return on equity (ROE), price-to-book ratio (PBR), and price-to-earnings ratio (PER), which are 8.0, 1.0, and 14.2 as of 2014~ 2023, to 11.6, 2.5, and 19.7, respectively, by 2035, which are the average levels of the MSCI Developed Index.

It also plans to increase its Capital Market Access Ranking (IMD) from 20th this year to 10th in 2035.

◆Goal of 50,000 venture companies in 10 years

The government has also decided to speed up the development of businesses in order to build a highly productive economic system.

The number of individual venture firms will increase to more than 50,000 by 2035, and the labor productivity of small and medium-sized enterprises will increase from 32.7 percent in 2021 to 50 percent in 2035, which is the OECD average.

Through this, it plans to secure the number of mid-sized and large enterprises (more than 250 employees) from 5.06 million in 2022 to more than 8 million in 2035.

To this end, the government will promote support for ‘customized corporate scale-up’ for each growth stage.

First, measures to revitalize venture investment will be prepared in the second half of the year to support start-ups and venture companies.

The measures include improving corporate venture capital (CVC) investment regulations, expanding the scope of venture fund investors, expanding the size of secondary-only venture funds, and increasing global venture investment inflows.

Starting next year, private investment will also be promoted by increasing the size and specialization of venture capital (VC) and increasing the proportion of CVC investment. SMEs induce corporate growth through taxation, financing, and financial support.

In the second half of this year, the government will increase the grace period for small and medium-sized enterprises (SMEs) from three years to five years and announce measures to nurture promising SMEs.

Medium-sized and large companies plan to conduct research services in the second half of this year to review overall regulations and prepare rational improvement plans, and based on this, they plan to start public discussion from next year.

At the same time, the government will re-promote the enactment of the Basic Law on the Development of the Service Industry to foster the service industry. The bill includes a plan to set up a body to mediate social conflicts that hinder the development of the industry from next year.

Artificial intelligence (AI)-semiconductors, quantum, and biotechnology will also expand investment in three core technologies.

A cross-ministerial task force (TF) in the field of AI-semiconductors will be formed to establish AI legislation and governance system in the second half of this year, and support for the entire semiconductor ecosystem will be strengthened, including financial support worth KRW 18.1 trillion.

◆Supply chain fund support of KRW 5 trillion

The government will establish a trade policy roadmap and announce it in the second half of the year with the goal of becoming the world’s No. 1 free trade agreement (FTA) by 2027.

The ongoing Malaysia-Thailand FTA negotiations will be completed in the second half of the year, and the China-Japan FTA negotiations will also be accelerated.

In the second half of this year, the supply chain fund of KRW 5 trillion will be launched, and the Supply Chain Stabilization Committee will be activated to establish a basic plan for supply chain stabilization (2025~2027) and prepare implementation plans for each ministry. .

It also reduces the gap between non-metropolitan and metropolitan areas.

It aims to increase the contribution of non-metropolitan areas to the growth of the gross regional domestic product (GRDP) from 29.9% in 2022 to 50% in 2035.

To this end, it plans to start work to revamp the national land use system, form a council of related institutions with the participation of related ministries and research institutes such as the Korea Research Institute for Human Settlements in the second half of this year, and launch a national land recreation project through research services next year.

In order to foster innovation clusters centered on the public, private sector, and universities, a plan to reorganize the special zone system will be prepared in the second half of the year.

From next year, it will support the creation of a new national high-tech industrial complex in connection with the special system.

In addition, within the next year, a joint task force (TF) of relevant ministries and local governments will prepare a plan to strengthen the capacity to attract local investment, and in order to solve the decrease in the working-age population and the shortage of manpower in high-tech fields, we will promote the cultivation of high-tech talents and the expansion of foreign manpower.

◆Public institution job salary expansion, day of the week and public holidays examination

The government has decided to revamp the wage system by expanding the introduction of salaries in the public sector, and to consider making the existing public holidays a day of the week for work-life balance.

First of all, the introduction of job pay will be expanded from the public sector, with the goal of expanding the job pay system, which is currently in effect in 109 institutions (as of April), to 200 institutions by 2027.

In order to spread the job- and performance-based wage system to the private sector, we will establish an integrated wage information system, provide consulting for small and medium-sized companies, and establish an evaluation and certification system for companies that have converted to a wage system.

In addition, based on the social dialogue of the Economy, Social and Labor Committee, a “roadmap for continuous employment” linked to the reorganization of the wage system will be prepared in the second half of the year.

In addition, we will consider improving the public holiday system to revitalize work-life balance.

Currently, substitute holidays are established on some public holidays, but substitute holidays are not applied to January 1 and Memorial Day, resulting in a deviation in the number of public holidays per year.

Accordingly, the government decided to prepare a plan to improve the holiday system, including alternative holidays and day-of-the-week holidays in the second half of the year, and to study the work and rest system of developed countries, such as ways to improve the choice of rest time and various salary payment systems (such as payment twice a month).

At the same time, the ‘2nd Social Mobility Improvement Plan’ will be announced in the second half of this year to attract young people with employment difficulties such as job search abandonment, isolation, and self-reliance preparation.

The project to introduce foreign housekeepers (housekeepers), which is scheduled to be piloted from the second half of the year, will be considered to expand to all care services from next year.

The salary for parental leave, which is 1.5 million won this year, will be raised to 2.5 million won next year, and the number of installments of parental leave will be expanded to build a foundation for flexible use of the childcare support system.

Nam Nam Woong, Mobile Reporting Department Reporter nkw778@hanmail.net

Copyright Holder: © IPN News All Rights Reserved